How to Ensure that You Are Buying the Right Professional Indemnity Insurance Plan?

Not only professionals but even companies can derive immense benefits by buying and putting in place an appropriate professional indemnity insurance plan. But how you, as a professional or an entrepreneur, can ensure that you are purchasing the right plan? Experts opine that if you avoid a few mistakes during the purchase process, you will be able to buy the right policy.

If you are looking for commercial vehicle insurance, do consider Allegiance Vehicle Insurance. They cover a wide range of insurance not only for vehicle, but for personal and corporate. You should check out their site today.

Let us delve a little deeper into this.

1. Not understanding the differences between the policies that are available.

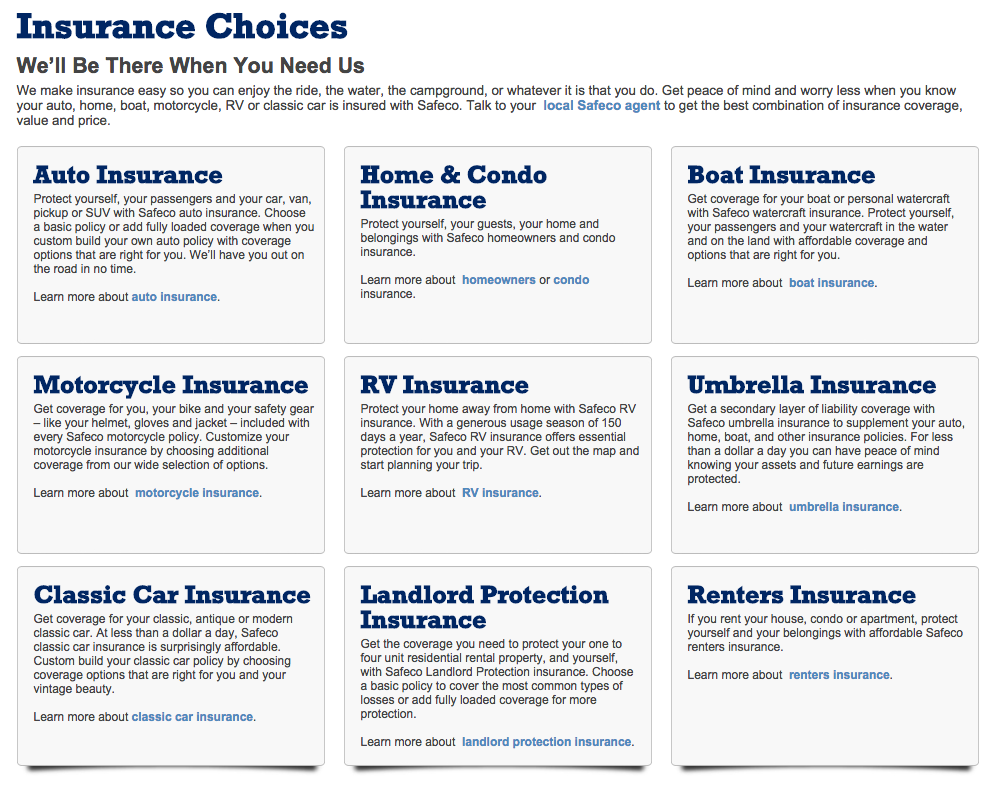

It is true that general insurance companies offer various types of policies including the vehicle insurance plans. Therefore, there are chances of you feeling overwhelmed, especially due to the enormous amount of data and details you may have to study. Regardless of this fact, it is imperative that you should be able to know the clear distinctions between the features of policies that are on offer. Otherwise, you will be buying a wrong plan and this may be perilous to your profession or company. You should therefore study the policies thoroughly, understand their features fully, and then, make the right choice.

2. Not ensuring that the policy you buy covers the risks adequately.

The policy you buy should cover all the risks to an adequate extent. You may argue that it is difficult to quantify the impact of the risks involved in your profession. Though this is true, if all the risks are not covered adequately, you may be put to a heavy loss. Not only that, you may lose your peace of mind as well. It is in this context you are advised to seek the advice of experts with reputed general insurance companies so you can almost be certain that all the risks pertaining to your profession are covered adequately.

3. Choosing policies based on their premiums alone.

This is another huge mistake but unfortunately, a number of companies and professionals commit this blunder. Of course, cost is an important factor you should take into account while buying insurance policies. But it should not be the sole factor. You must take into consideration several other factors as well that include deductible limits, the attitude of the companies while dealing with their clients, and so on. If you buy an insurance policy based only on the premiums, there are chances of the policy not providing you with adequate cover against the risks involved in your profession.

4. Not studying the ratios between the claims received and the settlements made by the insurance companies.

If you choose a general insurance company the claim-settlement ratio of which is very low, likelihood of your claims getting rejected will also be high. You must not overlook the fact that almost all the insurance companies work with a profit motive. Therefore, it is important that you study the client-satisfaction outlook of the companies before you zero in on the best entity.

If you keep these points in mind, you can certainly buy the right insurance plan that is suitable for your profession or company. To know more get in touch with Allegiance Vehicle Insurance today.